Inevitably, most companies experience challenges related to cash flow, revenue decreases, funding shortfalls, or setbacks in general that require a tightening of the belt. But organizations frequently have a tough time deciding which strategies and tactics to utilize to muscle through these situations in a way that’s strategic for the present time as well as for the future.

Interestingly enough, it is essential to take advantage of these difficult situations because often your best decisions are made when you have constrained resources. When companies believe that resources are somewhat unlimited, they tend not to be as innovative about how to stretch dollars and get the biggest bang for the buck.

When you are forced to stretch these dollars, real innovation can happen throughout the company or project. I find that it’s not just about saving money but executing the vision. It’s incredible what people can unlock when forced to find clever solutions. But for this to be successful, you must communicate a clear plan of action to the organization.

From Experience

I’ve been through these up-and-down cycles on a regular basis, so I understand the need for a strategy.

One of the first times I encountered this situation was when I was President at Embry-Riddle Aeronautical University. The previous eight years had seen rapid expansion, but during my first year, new class admissions fell. The debt covenants required a balanced budget each year, so cutbacks were necessary. Most employees had no memory of ever reducing costs.

At Insitu, we had great success with our customers, but funding was delayed sometimes. So, we had to find ways to stretch the dollars we had, basically living on fumes. It seems like for 25 months that we lived with three days of cash in the bank. When we arrived at work on Monday, it was our job to find a way to have enough cash flow to last until Friday to make payroll. We did every week, and the company ended up with a great outcome. Today, it’s wildly successful, growing bigger and bigger, and I hope that it will be a $1B company soon.

These two examples are not isolated cases. I find that there is a constant need to deal with the financial ups and downs at most companies. So, I created a list of priorities for these situations.

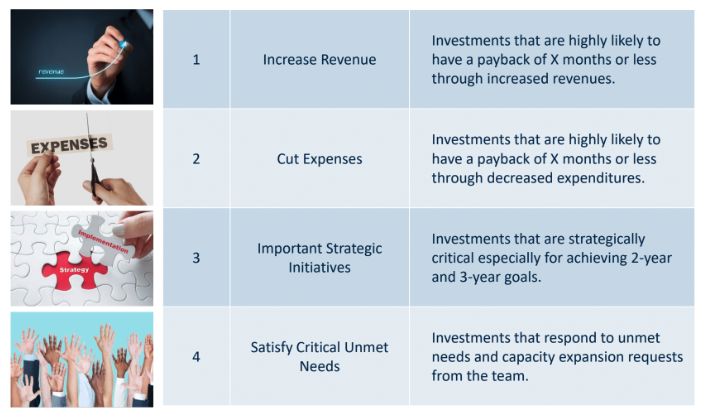

Four Spending Priorities

The order of these priorities is how I rank them in importance, although they must all be considered as I discuss below.

Priority 1: Increase Revenue

When a company has constrained resources, my first suggestion is to look for a way to generate a quick payback, ideally in 6 to 18 months. I do not recommend creating any product or introducing a service with the mentality of “If you build it, they will come.” Instead, create a model that shows, as concretely as possible, that if funds are invested, then there are customers who will soon pay you in excess of what was invested. This is not a time to take on additional risk.

When a company has constrained resources, my first suggestion is to look for a way to generate a quick payback, ideally in 6 to 18 months. I do not recommend creating any product or introducing a service with the mentality of “If you build it, they will come.” Instead, create a model that shows, as concretely as possible, that if funds are invested, then there are customers who will soon pay you in excess of what was invested. This is not a time to take on additional risk.

Priority 2: Cut Expenses

Be creative and look for ways to cut expenses and not only reduce expenditures. For example, if your company makes a lot of deliveries but your truck is old with high maintenance and fuel costs, consider replacing the truck. The expenses are easy to compute. If you realize payback in only 18 months, then the savings may be worth it.

Or, if you currently use a copy service. Analyze the costs to see if you could cut expenses by doing it in-house. Would you get a return by investing now?

By the way, each of these examples could be reversed. Could an in-house truck be sold to generate cash and expenses reduced by outsourcing? Could outsourced copying be cheaper than in-house systems?

Priority 3: Important Strategic Initiatives

This is where most companies make a critical mistake. I see it over and over, especially with start-ups. Most people want to spend money on exciting new projects and make forward progress. Unfortunately, without funds to run the day-to-day business, these initiatives will never happen. I agree that it is frustrating to have to prioritize spending on increasing revenue and cutting expenses in the near-term over strategic initiatives, but one must do so for the long-term success of the organization.

Always keep a list of exciting key initiatives so that if budgets can be trimmed, low-performance initiatives cut, revenue increased, or expenses reduced, then money could be made available to fund initiates that are likely to power the future.

Priority 4: Satisfy Critical Unmet Needs

Squeaky wheels always exist, and expenses come up. I’m talking about ones that are real bottlenecks that hinder work, not nice-to-have items. For example, maybe the HVAC system needs replacing, or production has a capacity constraint. While you cannot account for these in Priorities 1, 2, or 3, you still must address them. Hopefully, you have the extra dollars, but the point is to prioritize.

Allocation Process

The number one priority is to increase revenue, but that doesn’t mean that you allocate all of your money to that bucket. Priorities 1 and 2 probably won’t pay back in less than a year, but hopefully soon and based on the payback period you initially projected.

What I’ve done in the past is to create a group that determines the distribution. Once we have a mechanism in place, then when people make resource requests, I require the CFO and/or Controller to evaluate the opportunity and sign off on the payback period based on their analyses. These decisions are not based on hunches or gut feelings but from very specific research and intense scrutiny.

People Aspect

As you work through these times, be aware of the potential negative impact on morale. When people see that finances are tight, then they may leave. So, be sensitive to the fact that if you overly and aggressively state the spending and resource constraints, you may be driving away your best talent. I combat this by reminding the company that this is temporary and we are currently behind the eight ball. But as soon as we get things turned around a bit, we hope to be back to normal modes of growth and operation. I encourage everyone to keep the faith.

I also spend time consulting and counseling key people around the organization. I explain that our goal is to be wise stewards of the company’s capital, and we need to get to the point where revenue is growing. The team is still critical, so I tell them to make requests in all four areas, particularly to address any critical unmet needs. These appeals receive a higher priority since they come from people I rely on to drive the company forward.

Illustrative Example

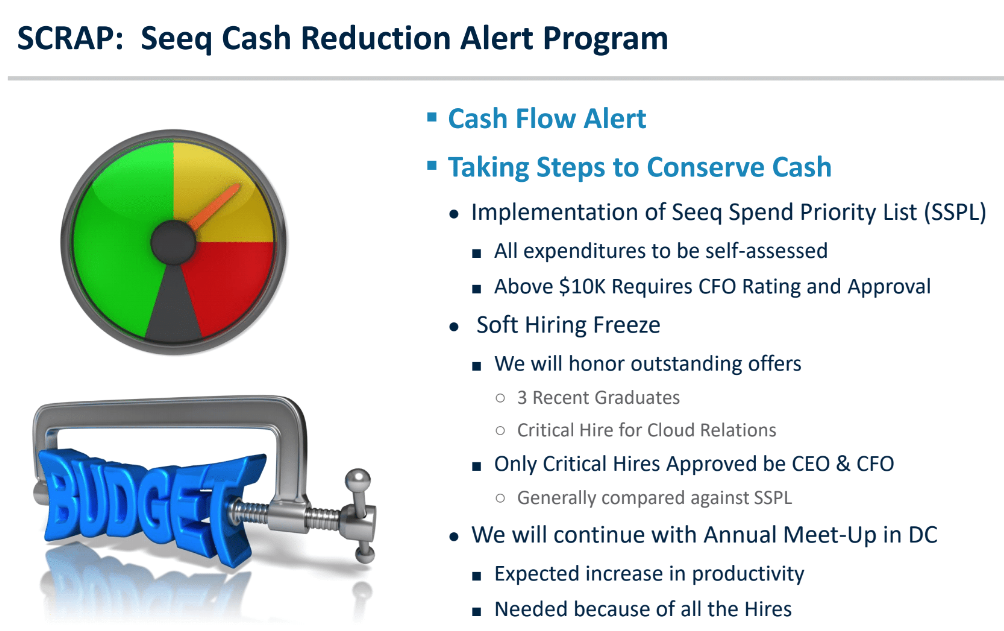

The sooner you realize the organization is headed for a slowdown, the sooner you can make adjustments. At the first hint of a problem, monitor your situation carefully. At Seeq, when we realized our cash flow was running behind projections for a couple of months, we immediately assessed the situation and put the following procedures in place.

First, I met with the CFO and Executive Council to devise a Seeq Spend Priority List (SSPL) for conserving cash. We addressed three areas – expenditures, hiring, and the annual meet-up. Any expense above $10k required the approval of the CFO. We implemented a soft hiring freeze where we would honor all outstanding offers and continue with one critical hire that we knew would move the needle. Any other hires required the approval of the CEO and CFO.

The final area was the annual weeklong meet-up in Washington, D.C. Our meeting last year had 35 employees, and this year we will have 110. Due to the enormous growth, we decided that it would increase motivation and productivity to have everyone in the same location. Yes, it is a significant expense that we could have cut, but what would that have done to morale? It isn’t always the correct choice to cut expenses. Work with your management team to develop a plan that addresses your circumstances.

Notice that our program was nicknamed, SCRAP. There were many conversations around the company on how we could be scrappy. Everyone participated, and we had almost instant positive results.

In a Nutshell

While it’s tempting to try to wait out issues related to constrained resources or randomly cut expenses and hope for the best, it is not sound management. By implementing a course of action as soon as you see warning signs, you are in a better position to take evasive action.

Share this Post