When hiring a new employee at a startup, figuring out the compensation package is slightly more complicated than a traditional company because those businesses need to conserve cash. In previous hiring situations like this, I find that there is a black art related to figuring out what salary to offer and the corresponding stock options. A hiring manager must figure out how sensitive a potential hire is to base pay versus how much upside they want to have in the future. One is continuously forced to try and make the tradeoffs on what it is going to take to get the valuable people they need. It is a guessing game to some degree because we do not know what motivates an employee – higher salary or more stock options.

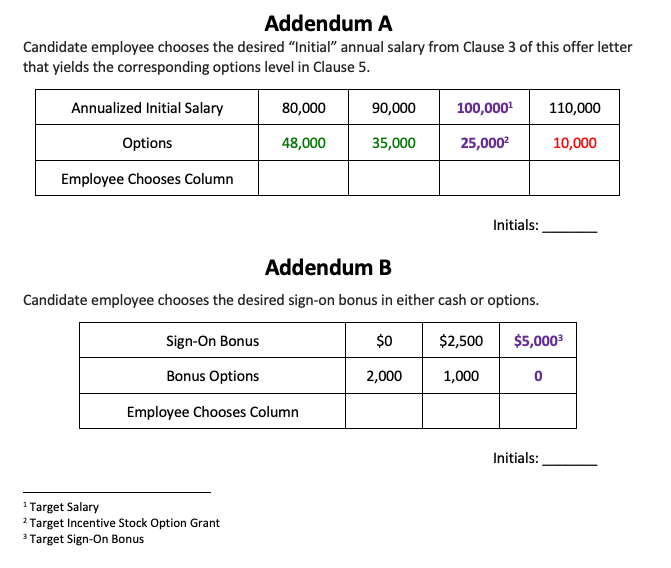

When starting Seeq, I decided to be explicit about the tradeoffs, letting candidate employees decide. As a new business, we are trying to save money, so cost savings, in general, are required. Therefore, we provide people with a choice. We attach an addendum to every offer letter we send, which includes a selection grid with a target salary, incentive stock option grant, and a sign-on bonus. This strategy can be used in any organization that offers stock options or sign-on bonuses as part of their compensation package.

Salary

In Addendum A, the target salary is $100K with 25K options. This is the target pay for that employee. However, it is up to them to make the final decision. They may choose a lower or higher amount on the provided curve.

If an individual wants more money, then that means receiving fewer options. Since the company must give up cash, the candidate forfeits some of the options. In this case, they receive $110K but only 10K options.

If someone can take an upfront cut in pay for a period of time, then they receive more options. It is important to note that the reduction in salary is temporary. In Seeq’s case, it currently lasts 18 months, but other businesses may find that 12 or 24 months works better. During that time, the pay begins to increase to the initial target amount. In the meantime, the company saves cash.

The computation of options must be slightly better than if selling the options. Perform the math such that it is beneficial to everyone. It should be a little worse for those taking more money upfront since most businesses are trying to conserve cash. If an employee helps reduce expenditures, the computation should be in their favor.

Sign-On Bonus

A similar approach exists with the sign-on bonus, Addendum B. The target bonus in this case is $5K with zero options. The candidate employee has the choice to increase their stock options for a reduced bonus. In Seeq’s case, 95% of employees join at a reduced salary, so we encourage them to take a one-time bonus to help with the transition. Other organizations may want to encourage more savings and set the target bonus at zero with a higher number of options.

Offer Acceptance

Using this strategy as part of the offer process makes it fun because instead of simply answering yes or no, they must do the math and analyze the information. I think the company should be neutral to the decision and clearly communicate that. I do not view anyone as more or less of an entrepreneur because of a chosen number. The goal is to make the individual feel comfortable and allow them to determine what works best based on their circumstances. Some families need cash now, while others can afford to do with less. Only the potential hire knows their situation.

I have experienced every combination possible. Sometimes, people go off for a week or two, analyze the data, come back, and accept the initial recommendation. Others do more analysis and end up in the middle. Several people go all the way to the left, which is common when they think about the process more. They learn the value of options, which forces them to think of the tradeoffs. Since their pay increases over time to the target salary, it is easy to see that receiving more options will be better over time. A reduced salary and full bonus is a combination I see frequently.

Corporate Benefits

One benefit of this strategy is that it accelerates people past the go/no-go decision, and people become excited about the situation. No longer is it a decision of should they join, it is “How do I join, and what makes the most sense for me?” This forces them to think about the risk-reward profile, where they sit in the process, and what they should do. This transitions the decision from the organization trying to guess what motivates someone to the candidate making the decision.

Another advantage is that the process maximizes the cash businesses can save because hiring managers are not always brave enough to offer low salaries. They do not want to miss out on a talented person. With this approach, one offers a range so that the employee decides. It is all on the table. In my experience, more often than not, people take less cash.

I also maintain that it energizes the decision process. Candidates ask more questions about the future of the organization, what their role would be, and how they can make a difference in terms of making the stock more valuable. This is great for shareholders.

The hidden benefit is that everyone has a natural tendency to negotiate. In fact, they think it is expected and the right thing to do. This process already has a curve where we provide the opportunity to choose more salary. By providing a range of possibilities, this makes it seem better than agonizing over a counteroffer and begging for a change.

In advanced startups, almost every new employee will be on the curve. For newly formed businesses or in a situation where a new role is created, some negotiations may take place. For example, someone may suggest a different curve. “I think this role can add significant value to the organization because of x, y, and z. Shouldn’t I be on a different curve?” In some cases, we agree on a different amount.

Clearly, the curves for salaries, options, and bonuses must vary based on the role and seniority. This is no different from any other company. Adjustments on curves sometimes happen. When someone comes into a department with people similar in rank and experience, the hiring manager must explain that it is not fair to everyone else in the group to single that individual out. We ask them to find their place on the curve, and I find this works well in the majority of cases.

Sliwa Thoughts

I believe that this approach benefits individuals by allowing them to customize their compensation package, while minimizing cash expenditures for startups. It is a great opportunity to make the tradeoffs in a way that is fair and visible. I have shared this strategy with various people, including CEOs and board members, and they like it. In fact, many are trying to adopt something similar.

Part of me wants complete transparency with salaries. The problem is that it is not fair for people’s decision grids to be visible. For example, in one case, an individual had to take more money because her mother was sick, and she was taking care of her. That’s not fair for her to be judged. Some people may view her opting for more money as having less confidence in the company.

Most companies do not publish salary and options for every position. I wish all companies could, but this process takes it off the table. Overall, the strengths and benefits of this program are much better than the alternatives.

Share this Post